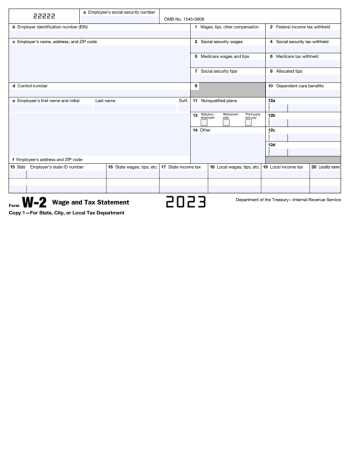

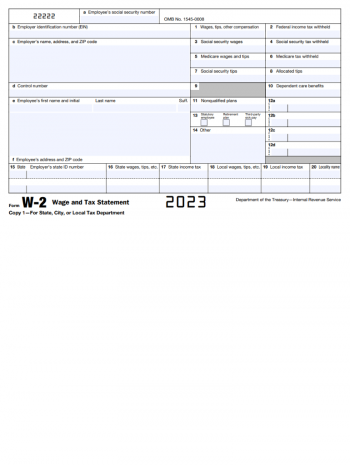

Simplified W-2 Form Instructions

As tax season approaches, many of us navigate a maze of tax forms and regulations. One form that stands out for its critical role in the tax filing process is the IRS Form W-2. This form, necessary for anyone who has earned a salary, wage, or other forms of compensation from an employer over the past tax year, is not just a piece of paper—it's the cornerstone of the income tax return for many Americans. Employers must furnish Form W-2 to their employees and the IRS by January 31st, ensuring that employees have ample time to file their taxes. It's also worth noting that while Form W-2 is mandatory for employees to report their income, self-employed individuals use other forms to report their earnings.

Key Elements of IRS Form W-2

- Employee's personal and financial information, including Social Security Number and wages earned.

- Employer's identification includes the Employer Identification Number (EIN) and address.

- Breakdown of federal, state, and other taxes withheld from the employee's income.

- Contributions to retirement plans, health insurance, and other benefits.

- Codes indicate various compensation or benefits provided beyond standard wages.

Both employers and employees must ensure the accuracy of IRS Form W-2. Discrepancies can cause delays in tax return processing and may even lead to penalties.

Avoiding Common IRS Form W-2 Mistakes

When it comes to completing the IRS Form W-2, certain missteps can cause needless headaches during tax season. Below, we list some frequent errors and offer advice on how to sidestep them before you prepare the W2 online for free.

- Incorrect employee information

Always double-check Social Security Numbers and personal details to avoid mismatches with IRS records. - Inaccurate financial data

Ensure all wages, tips, and other compensation are reported with precision to avoid potential audits and amendments later on. - Incorrect tax amounts

Verify the federal, Social Security, and Medicare taxes withheld to prevent discrepancies that could impact your tax liabilities or refunds.

Fortunately, many of these mistakes can be circumvented by using a free fillable W-2 form available online. These interactive forms can reduce calculation errors and properly report all necessary information. As more people are trying to save costs where possible, the option to fill out the W2 online for free becomes increasingly appealing.

Looking ahead to the 2023 tax year, it is possible to find a free W-2 online form, which employers can utilize to streamline the process of generating accurate tax documents for their employees. By capitalizing on tools like a free W-2 form for 2023, both employers and employees can ease the burden of tax preparation, ensuring a smoother tax filing experience for all parties involved. Remember, while the convenience of digital solutions is undeniable, reviewing and verifying every detail remains crucial.

Related Forms

-

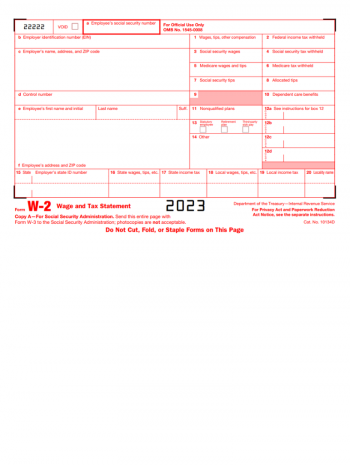

![image]() W-2 Understanding IRS Form W-2 is crucial for employers and employees in the United States. This essential document is an annual wage and tax statement that employers must furnish to their employees and file with the Internal Revenue Service (IRS). It details the employee's income from the previous year, including wages, tips, and other forms of compensation. Moreover, it breaks down the taxes withheld from the employee's earnings, such as federal income tax, Social Security tax, and Medicare tax. A... Fill Now

W-2 Understanding IRS Form W-2 is crucial for employers and employees in the United States. This essential document is an annual wage and tax statement that employers must furnish to their employees and file with the Internal Revenue Service (IRS). It details the employee's income from the previous year, including wages, tips, and other forms of compensation. Moreover, it breaks down the taxes withheld from the employee's earnings, such as federal income tax, Social Security tax, and Medicare tax. A... Fill Now -

![image]() Blank W-2 Form in PDF For those of us entrenched in the world of finance, either as educators or practitioners, the advent of tax season brings with it a familiar friend: the W-2 form. It might evoke sighs or shrugs from students and professionals alike, but this form is the linchpin of the tax filing process in the United States. The W-2 form reports an employee's annual wages and the amount of taxes withheld from their paycheck. While most people are used to receiving this document without much fuss, there are instances where accessing or filling out this form can be anything but straightforward. IRS Form W-2 in Work: Let's Consider an Example Consider, for instance, a freelance consultant who took on a part-time teaching position for a single semester. They're accustomed to 1099s, not W-2 forms. In this atypical circumstance, they might need to download a blank W-2 form in PDF format to manually report their earnings from the teaching gig. Or take an expatriate who, upon returning to the US, realizes that their employer has been remitting taxes to the IRS without providing them with a W-2. They would need to get their hands on a W-2 form fillable in PDF to input their details and ensure they are properly accounted for come tax time. What if you're a start-up founder and your bookkeeper left amid tax season? The responsibility of procuring the W-2 documents falls on you. In this scenario, it's essential to have access to the W2 editable in PDF to expedite the process. This can be crucial in meeting tax deadlines and ensuring your employees are not left in the lurch. Federal Form W-2: Errors and Corrections Errors on tax documents can be daunting, so it's vital to approach them with a calm and systematic strategy. Should you notice a discrepancy, the first step is to contact your employer to issue a corrected W-2. However, if the deadline is looming and a corrected form isn't available, you can use IRS Form 4852 as a substitute. As a financial educator, I always stress to my students the importance of double-checking their forms before submission. For additional guidance, they can refer to the W-2 instructions in PDF, which provide detailed steps for addressing various mistakes. After all, accuracy is vital to avoid potential issues with the IRS. The key is not to panic but rather to take proactive steps immediately upon uncovering any inaccuracies. Popular Questions About the W-2 Tax Form Where can I obtain a W2 form for 2023 in PDF if my employer has not provided one?You can download the blank template for the 2023 tax year from our website by clicking the "Get Form" button or request your employer to provide a copy electronically. What should I do if I accidentally use the wrong social security number on my W-2?Contact your employer immediately to have them issue a corrected W-2. Remember to check the rest of your personal information for errors as well. Can I file my taxes without my W-2 form?It is recommended to wait for your W-2 to arrive to file your taxes accurately. If it's delayed, you may use Form 4852 as a placeholder to estimate your wage and tax information. Fill Now

Blank W-2 Form in PDF For those of us entrenched in the world of finance, either as educators or practitioners, the advent of tax season brings with it a familiar friend: the W-2 form. It might evoke sighs or shrugs from students and professionals alike, but this form is the linchpin of the tax filing process in the United States. The W-2 form reports an employee's annual wages and the amount of taxes withheld from their paycheck. While most people are used to receiving this document without much fuss, there are instances where accessing or filling out this form can be anything but straightforward. IRS Form W-2 in Work: Let's Consider an Example Consider, for instance, a freelance consultant who took on a part-time teaching position for a single semester. They're accustomed to 1099s, not W-2 forms. In this atypical circumstance, they might need to download a blank W-2 form in PDF format to manually report their earnings from the teaching gig. Or take an expatriate who, upon returning to the US, realizes that their employer has been remitting taxes to the IRS without providing them with a W-2. They would need to get their hands on a W-2 form fillable in PDF to input their details and ensure they are properly accounted for come tax time. What if you're a start-up founder and your bookkeeper left amid tax season? The responsibility of procuring the W-2 documents falls on you. In this scenario, it's essential to have access to the W2 editable in PDF to expedite the process. This can be crucial in meeting tax deadlines and ensuring your employees are not left in the lurch. Federal Form W-2: Errors and Corrections Errors on tax documents can be daunting, so it's vital to approach them with a calm and systematic strategy. Should you notice a discrepancy, the first step is to contact your employer to issue a corrected W-2. However, if the deadline is looming and a corrected form isn't available, you can use IRS Form 4852 as a substitute. As a financial educator, I always stress to my students the importance of double-checking their forms before submission. For additional guidance, they can refer to the W-2 instructions in PDF, which provide detailed steps for addressing various mistakes. After all, accuracy is vital to avoid potential issues with the IRS. The key is not to panic but rather to take proactive steps immediately upon uncovering any inaccuracies. Popular Questions About the W-2 Tax Form Where can I obtain a W2 form for 2023 in PDF if my employer has not provided one?You can download the blank template for the 2023 tax year from our website by clicking the "Get Form" button or request your employer to provide a copy electronically. What should I do if I accidentally use the wrong social security number on my W-2?Contact your employer immediately to have them issue a corrected W-2. Remember to check the rest of your personal information for errors as well. Can I file my taxes without my W-2 form?It is recommended to wait for your W-2 to arrive to file your taxes accurately. If it's delayed, you may use Form 4852 as a placeholder to estimate your wage and tax information. Fill Now -

![image]() W2 Form for 2023 Form W-2 is a fundamental document that plays a pivotal role in preparing an individual's tax returns in the United States. As the instructional texts for my finance students highlight, this form encapsulates the earnings and tax information from an employee's employer. It is a statement that reports an employee's annual wages and the amount of taxes withheld from their paycheck. As such, it not only serves as a record of the income tax that the employee may owe to the government but also provides proof of earned income and taxes paid throughout the fiscal year. Updates to the IRS W-2 Form With each passing year, the Internal Revenue Service (IRS) may implement changes to tax forms, reflecting new tax laws or modifications to existing policies. For those preparing their taxes, it's crucial to be aware of such revisions to ensure compliance and accuracy. These changes can affect the way you fill out the 2023 W2 form PDF and understand your tax liabilities. Keeping abreast with these updates can indeed be as enlightening as delving into a timeless piece of classic literature. Eligibility Criteria for Tax Form W-2 Applicants It's important to understand who qualifies for a W-2 and who does not. The issuance of a 2023 W2 tax form is required by any employer who pays remuneration, including non-cash payments of $600 or more for the year, for services performed by an employee. On that note, if you're an independent contractor or self-employed, you would typically not receive a W-2 but instead would need to look towards a Form 1099. This distinction is crucial for finance majors and anyone navigating the complexities of tax obligations, as it influences the filing process and one's tax liabilities. The IRS typically updates and releases the latest W2 printable form for 2023 at the end of the year. This ensures that employers have sufficient time to prepare and distribute the forms to their employees by January 31 of the following year. For employees, obtaining this form is the first step in preparing an accurate tax return. Filling Out the W-2 Form Without Errors: Our Recommendations Ensure all information is accurate and updated to make the most of the W-2 form. Reconciling the details with one's own records is essential. Furthermore, employers can better understand the kind of information they need to furnish by utilizing a blank W2 form for 2023. Understanding wage reporting requirements, tax withholdings, and other compensation can also benefit tax planning. Lastly, for those who are digitally inclined, engaging with a fillable W2 form for 2023 can streamline the process of completing your W-2. Such PDF forms offer the convenience of entering information directly through one's computer, reducing errors and enhancing the legibility of the data provided to the IRS and the Social Security Administration. Whether you’re submitting a hard copy or a digital version, ensuring the accuracy of the data is crucial for a smooth tax filing experience. Fill Now

W2 Form for 2023 Form W-2 is a fundamental document that plays a pivotal role in preparing an individual's tax returns in the United States. As the instructional texts for my finance students highlight, this form encapsulates the earnings and tax information from an employee's employer. It is a statement that reports an employee's annual wages and the amount of taxes withheld from their paycheck. As such, it not only serves as a record of the income tax that the employee may owe to the government but also provides proof of earned income and taxes paid throughout the fiscal year. Updates to the IRS W-2 Form With each passing year, the Internal Revenue Service (IRS) may implement changes to tax forms, reflecting new tax laws or modifications to existing policies. For those preparing their taxes, it's crucial to be aware of such revisions to ensure compliance and accuracy. These changes can affect the way you fill out the 2023 W2 form PDF and understand your tax liabilities. Keeping abreast with these updates can indeed be as enlightening as delving into a timeless piece of classic literature. Eligibility Criteria for Tax Form W-2 Applicants It's important to understand who qualifies for a W-2 and who does not. The issuance of a 2023 W2 tax form is required by any employer who pays remuneration, including non-cash payments of $600 or more for the year, for services performed by an employee. On that note, if you're an independent contractor or self-employed, you would typically not receive a W-2 but instead would need to look towards a Form 1099. This distinction is crucial for finance majors and anyone navigating the complexities of tax obligations, as it influences the filing process and one's tax liabilities. The IRS typically updates and releases the latest W2 printable form for 2023 at the end of the year. This ensures that employers have sufficient time to prepare and distribute the forms to their employees by January 31 of the following year. For employees, obtaining this form is the first step in preparing an accurate tax return. Filling Out the W-2 Form Without Errors: Our Recommendations Ensure all information is accurate and updated to make the most of the W-2 form. Reconciling the details with one's own records is essential. Furthermore, employers can better understand the kind of information they need to furnish by utilizing a blank W2 form for 2023. Understanding wage reporting requirements, tax withholdings, and other compensation can also benefit tax planning. Lastly, for those who are digitally inclined, engaging with a fillable W2 form for 2023 can streamline the process of completing your W-2. Such PDF forms offer the convenience of entering information directly through one's computer, reducing errors and enhancing the legibility of the data provided to the IRS and the Social Security Administration. Whether you’re submitting a hard copy or a digital version, ensuring the accuracy of the data is crucial for a smooth tax filing experience. Fill Now -

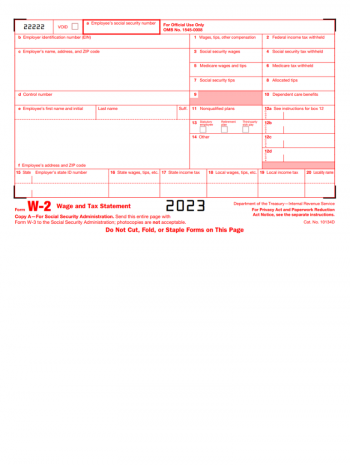

![image]() Free W2 Template Navigating the end-of-year tax documents can be overwhelming for both employers and employees. Among these vital documents is the W-2 tax form, a mandatory form used in the United States to report wages paid to employees and the taxes withheld from them. To help reduce errors and save time, it's essential to understand the printable W2 form template before filling it out. The form is divided into sections, each designed to capture specific information about the employee's earnings and deductions, including federal and state taxes, Social Security wages, and Medicare wages. Organized data entry fields facilitate a straightforward reporting process. Guidelines for Accurate W-2 Tax Form Completion Double-check the employee's personal information, such as their Social Security number and address, to ensure they're correct. Closely review the numbers entered for all income and tax withholdings to prevent any discrepancies. Employers must include their Employer Identification Number (EIN), which is essential for the IRS's tracking purposes. Ensure that the state income and tax withholding sections are duly completed if the employee works in a state that requires state income tax. Submitting Your IRS W-2 Form: A Step-by-Step Guide Once you have accurately filled out your free W2 template in PDF format, submitting it to the correct authorities is the next pivotal step. Begin this process by creating copies of the completed form - make sure to have enough for the Social Security Administration (SSA), your employees, and your records. Next, submit Copy A to the SSA; this can be done either electronically or by mail. In parallel, provide copies B, C, and 2 to your employee. They will need these for their tax filings. Keeping a copy of the W-2 tax form template for your business records is recommended, which can come in handy for future reference or in case of any discrepancies. Adhering to Submission Deadlines One of the perennial mistakes made during tax season is missing the submission deadlines. For the W2 template for 2023, employers must ensure that their employees receive their W-2 forms by January 31, 2024. Similarly, the SSA must receive their copy by the same date. Being mindful of these deadlines is crucial as it guarantees compliance with federal regulations and spares businesses from potential penalties. Resources and Assistance For those looking to handle their tax form needs efficiently, there are options to print the W-2 form template from various online resources. Employers can make use of the original forms available on the IRS website or, alternatively, use reputable online services that offer these forms for free. It's imperative to choose a source that provides the most updated version to avoid any compliance issues. Fill Now

Free W2 Template Navigating the end-of-year tax documents can be overwhelming for both employers and employees. Among these vital documents is the W-2 tax form, a mandatory form used in the United States to report wages paid to employees and the taxes withheld from them. To help reduce errors and save time, it's essential to understand the printable W2 form template before filling it out. The form is divided into sections, each designed to capture specific information about the employee's earnings and deductions, including federal and state taxes, Social Security wages, and Medicare wages. Organized data entry fields facilitate a straightforward reporting process. Guidelines for Accurate W-2 Tax Form Completion Double-check the employee's personal information, such as their Social Security number and address, to ensure they're correct. Closely review the numbers entered for all income and tax withholdings to prevent any discrepancies. Employers must include their Employer Identification Number (EIN), which is essential for the IRS's tracking purposes. Ensure that the state income and tax withholding sections are duly completed if the employee works in a state that requires state income tax. Submitting Your IRS W-2 Form: A Step-by-Step Guide Once you have accurately filled out your free W2 template in PDF format, submitting it to the correct authorities is the next pivotal step. Begin this process by creating copies of the completed form - make sure to have enough for the Social Security Administration (SSA), your employees, and your records. Next, submit Copy A to the SSA; this can be done either electronically or by mail. In parallel, provide copies B, C, and 2 to your employee. They will need these for their tax filings. Keeping a copy of the W-2 tax form template for your business records is recommended, which can come in handy for future reference or in case of any discrepancies. Adhering to Submission Deadlines One of the perennial mistakes made during tax season is missing the submission deadlines. For the W2 template for 2023, employers must ensure that their employees receive their W-2 forms by January 31, 2024. Similarly, the SSA must receive their copy by the same date. Being mindful of these deadlines is crucial as it guarantees compliance with federal regulations and spares businesses from potential penalties. Resources and Assistance For those looking to handle their tax form needs efficiently, there are options to print the W-2 form template from various online resources. Employers can make use of the original forms available on the IRS website or, alternatively, use reputable online services that offer these forms for free. It's imperative to choose a source that provides the most updated version to avoid any compliance issues. Fill Now -

![image]() W2 Online Form Form W-2, also known as the Wage and Tax Statement, is an essential document for both employers and employees in the United States. As a university professor focused on finances, I cannot overstate the importance of this form, which details an employee's annual wages and the amount of taxes withheld from their paycheck. Every year, employers must provide this form to their employees and the IRS, usually by January 31st. For those who prefer the convenience of digital solutions, the possibility to fill out the W-2 online has modernized how we handle this obligatory annual task. Features of the W2 Online Form The modifiable W2 online form has been a significant stride toward simplifying the tax filing process. The automated version of the form reduces the chances of manual errors, as it can perform calculations automatically. This dynamic attribute ensures that the data entered is precise and compliant with the requisites set by the IRS. Moreover, the modifiable version usually integrates seamlessly with accounting software, which benefits both employers and employees, streamlining payroll data transfer with accuracy and efficiency. Filing the W2 Online: Potential Challenges While the convenience of managing and submitting tax documents digitally is evident, certain difficulties may emerge. For instance, navigating government websites to find the W-2 online can be less than intuitive for some users. Additionally, technical glitches or server overloads during peak filing periods can impede the online submission process, causing frustration and potential delays in meeting filing deadlines. Steps to Submit a W-2 Online Here are some recommendations to mitigate issues and ensure a smooth filing experience. Firstly, plan ahead and don't wait until the filing deadline approaches, allowing ample time to address any unforeseen complications. To obtain the necessary document, you can get the W2 online for free through our website or authorized providers, ensuring you access an official and secure version of the form. Employers must also legally furnish the document electronically upon a worker's request. While interacting with the online system, ensure that you have all the required information at hand, such as Social Security numbers and income data, to prevent any delays in the completion process. Secure a robust internet connection to avoid disruptions during the submission process. After successfully submitting your document, saving a confirmation receipt is crucial. Should any issues transpire post-submission, this receipt will be valuable in rectifying discrepancies with the IRS. Remember, accuracy and thoroughness are paramount when you file the W2 online. Taking these preparative and precautionary steps will help you lock in a hassle-free submission. Fill Now

W2 Online Form Form W-2, also known as the Wage and Tax Statement, is an essential document for both employers and employees in the United States. As a university professor focused on finances, I cannot overstate the importance of this form, which details an employee's annual wages and the amount of taxes withheld from their paycheck. Every year, employers must provide this form to their employees and the IRS, usually by January 31st. For those who prefer the convenience of digital solutions, the possibility to fill out the W-2 online has modernized how we handle this obligatory annual task. Features of the W2 Online Form The modifiable W2 online form has been a significant stride toward simplifying the tax filing process. The automated version of the form reduces the chances of manual errors, as it can perform calculations automatically. This dynamic attribute ensures that the data entered is precise and compliant with the requisites set by the IRS. Moreover, the modifiable version usually integrates seamlessly with accounting software, which benefits both employers and employees, streamlining payroll data transfer with accuracy and efficiency. Filing the W2 Online: Potential Challenges While the convenience of managing and submitting tax documents digitally is evident, certain difficulties may emerge. For instance, navigating government websites to find the W-2 online can be less than intuitive for some users. Additionally, technical glitches or server overloads during peak filing periods can impede the online submission process, causing frustration and potential delays in meeting filing deadlines. Steps to Submit a W-2 Online Here are some recommendations to mitigate issues and ensure a smooth filing experience. Firstly, plan ahead and don't wait until the filing deadline approaches, allowing ample time to address any unforeseen complications. To obtain the necessary document, you can get the W2 online for free through our website or authorized providers, ensuring you access an official and secure version of the form. Employers must also legally furnish the document electronically upon a worker's request. While interacting with the online system, ensure that you have all the required information at hand, such as Social Security numbers and income data, to prevent any delays in the completion process. Secure a robust internet connection to avoid disruptions during the submission process. After successfully submitting your document, saving a confirmation receipt is crucial. Should any issues transpire post-submission, this receipt will be valuable in rectifying discrepancies with the IRS. Remember, accuracy and thoroughness are paramount when you file the W2 online. Taking these preparative and precautionary steps will help you lock in a hassle-free submission. Fill Now